Motor vehicle injury lawyers Warrnambool

TAC legal advice in Warrnambool and surrounding areas.

If you have been injured in a motor vehicle accident in Warrnambool or surrounding areas, you should give consideration to lodging a TAC claim to assist you in your recovery.

What is the TAC?

The TAC is an insurance company that covers the costs if any injuries which are a result of driving a motor vehicle (car, motorbike, bus, train or tram). They also provide support services to people that have been injured on the road whether they are a driver, passenger, pedestrian, motorbike rider or cyclist.

Basically if you were injured due to a motor vehicle accident in Victoria, regardless of who’s fault, you’re able to pursue bene ts. These benefits will likely be paid by the Transport Accident Commission.

What injuries do the TAC cover?

The TAC covers a wide range of injuries and conditions, including:

- physical and/or psychological injuries suffered in a motor vehicle accident (note: the injury does not need to be serious or significant);

- an aggravation, deterioration or recurrence of injuries, disease, or illness caused by the accident.

- conditions including cancer, strokes, asthma, heart conditions, degenerative, or mental health conditions that are aggravated or exacerbated by an accident.

You need to show that there is some relationship between your injury/condition and the motor vehicle accident. If you can show this, you may be entitled to TAC benefits.

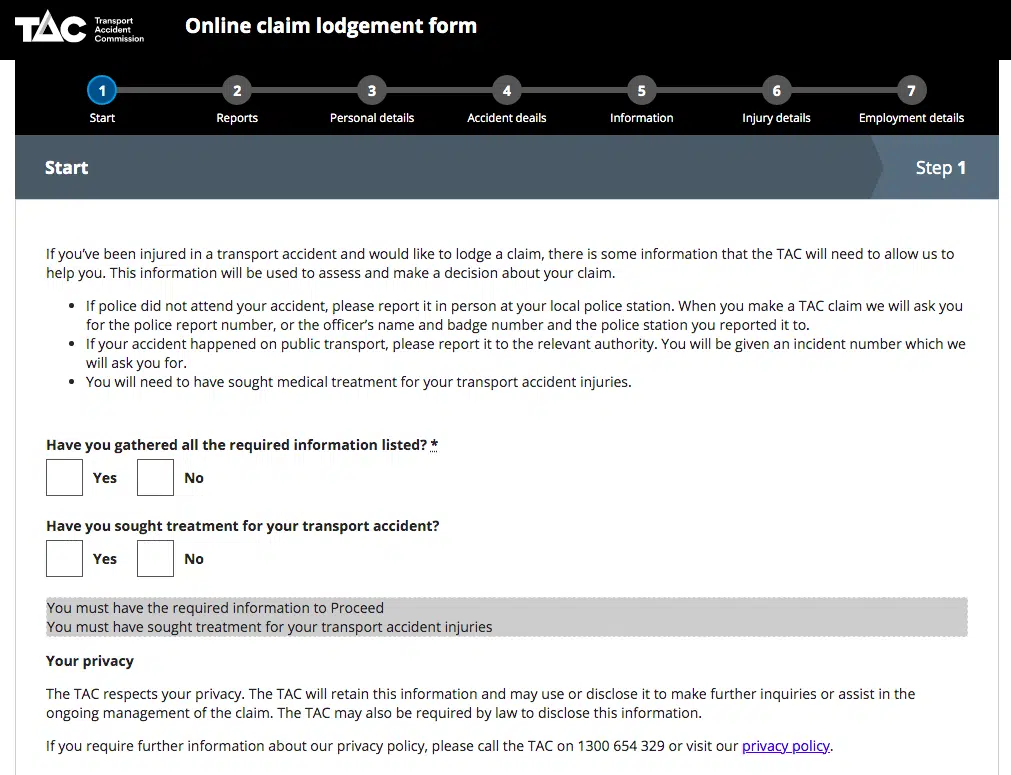

How do I make a TAC claim?

Option1:

Call the TAC on 1300 654 329. Let them know that you’ve been involved in an accident and they will lodge a claim over the phone for you.

Option 2:

Alternatively you can use their online lodgement form which can be found on their website.

Option 3:

If you were taken to hospital after the accident, some hospitals lodge claims on behalf of injured people. If you were hospitalised after a motor vehicle accident and you’re not sure whether a claim has been lodged on your behalf, you should contact the TAC or the hospital.

Information you should have at hand before lodging a claim

Whether you decide to call the TAC or alternatively lodge the claim online, you should ensure you have to hand the following information.

- How the accident happened.

- Where the accident happened.

- Details of any injuries that you sustained that you are aware of

- Your registration details and the registration details of any other vehicles involved.

- The names of people that were in your car at the time and the names of any other people involved in the accident.

- The details of any witnesses.

- If police attended the scene, If you have reported the accident to police already, The details of the police officer of offices that attended the scene, or the station that you reported it to.

- The name of any medical practitioners that you have seen for treatment.

- Details of any hospitals you have attended.

- If you have had more than five days off work due to the accident, then you need to provide any income details.

- Your bank details.

- If you were involved in an accident involving public transport, then you should have the name of the public transport operator (e.g. metro trains) and any other information that you were able to provide such as the vehicle number, where the accident happened, when it happened and the name of any public transport driver.

What happens after my claim is lodged?

The TAC will send you documentation to sign and return to them.

They will determine your claim within 21 days after lodgement, unless they require further information (they will let you know if they do).

If they do require further information, then it may take longer for your claim to be determined.

Once they have made a decision about your claim, you will receive a notice in writing letting you know whether your claim has been accepted or rejected.

Will the TAC accept my claim?

If you were injured due to a motor vehicle accident then there’s a good chance your claim will be accepted.

Here’s an important bit of information – Victoria has what’s called ‘no fault’ compensation. Basically, that means that even if you were in some way responsible for the injury, you are still able to lodge a claim.

Being at fault for an injury restricts what you’re entitled to, but doesn’t stop you from making a TAC claim for ‘no-fault’ benefits.

How will I know if my TAC claim is rejected?

The TAC will provide you with written reasons as to why your claim was rejected. Sometimes claims are rejected because the TAC need more information. Another reason is because the accident was not reported to the police.

Generally speaking, the TAC will accept the vast majority of claims that are made.

If however your claim is rejected, then there are procedures in place to enable you to challenge this decision.

Do I need to show that someone else was at fault in order to lodge a TAC claim?

No, regardless as to whether someone else was at fault for the accident or not is irrelevant. You are able to lodge a TAC claim if you suffered any injury on the road.

However, if you were at fault for the accident, you were only able to access your no fault entitlements. This means weekly payments, medical and like expenses and an impairment benefit. In order to pursue a common-law claim, you need to show that someone else was at fault for the accident.

How do I find my TAC claim number?

Your TAC claim number should be on any correspondence that you received from the TAC.

If you cannot locate your TAC claim number, it is best to contact the TAC on 1300 654 329 and ask to speak to a representative.

What will TAC cover?

1. Medical expenses

The TAC will cover all reasonable medical, hospital, nursing, personal and household, occupational, rehabilitation and ambulance services.

•Doctor, chemist, physiotherapy, and chiropractor bills are covered, as are appointments to see your specialist, and surgery (if approved by the TAC).

•Mobility devices and special equipment, home and car modi cations and transportation costs are also covered (again, if approved by the TAC).

•There is no set time limit on how long your entitlement to medical expenses will run for.

If the TAC does stop or refuse to pay for any treatment, you have 12 months from the decision date to challenge the decision.

There is no way to extend the 12 month period and as such it is very important to get legal advice quickly after a decision has been made.

2. Weekly payments

If your injuries prevent you from being able to do your job properly, whether that’s because you can’t work at all, or can only do some of what you normally would, you will be entitled to weekly payments.

To get payments through the TAC, you will need to get a certificate of capacity from your GP or another health professional. Most health professionals you see are approved to provide TAC certificates, other than psychologists. It is usually best to have your GP write your certificates as you see them on a regular basis.

Payments are based on an average of your wage of the 12 months before the injury, with a few exceptions. This is called your pre-injury average weekly earnings, or PIAWE.

How long can these payments go for, and how much of your PIAWE do you get?

Here’s a summary:

- If your gross income is less than $708* a week, they pay you 100% of your income.

- If 80% of your gross income is less than $708* a week, they pay you $708* a week.

- If 80% of your gross income is between $708* and $1,430 a week, they pay you 80% of your income a week.

- If 80% of your gross income is more than $1,430 a week, they pay you $1,430 a week.

* $708 applies if you have no dependants. If you have one dependant, this rate is $908. For each extra dependant add $64. Figures correct at March 2021, may change in future.

Why is there a distinction between before 3 years and after?

Well, there’s a signifcant change in the elligibility test for payments at the 3 year mark. Before then, you just need to show that you can’t do your old job in an unrestricted way. After 3 years, you have to show that you have a 50% or greater “whole person impairment”. This knocks a lot of people off weekly payments, although you can challenge the decision.

3. An impairment lump sum

You may also be entitled to a lump sum for permanent impairment called an ‘impairment benefit.’ It doesn’t matter whether you were at fault or not – anyone injured in a motor vehicle accident is entitled to pursue this claim.

That’s not to say everyone that pursues an impairment claim succeeds. Many do not.

A key to success in this claim is to make sure that all of the injuries you suffered in the accident are assessed by specialist doctors.

Your injuries need to be graded by these specialist doctors. They will put percentage figures on each of your injuries. These figures will then get combined into one overall figure. This overall figure must reach a threshold in order for you to succeed. The higher the overall figure, the greater the chance of success in this claim and the more your claim is worth.

You can’t have your own treating doctors grade your injuries. You need to see specialist doctors who have undergone certain training that allows them to grade injuries in legal cases.

As of March 2021, the minimum payable was $8,040 and the maximum payable was $366,900. The figures change at the end of the financial year, each year.

The claim is made once the injury is stable (meaning not getting significantly better, not getting significantly worse).

4. A common law claim for damages

Some people are also able to pursue a second lump sum called a common law claim.

This claim is where you’re suing another party for their negligence.

Just because you were injured in a motor vehicle accident doesn’t mean you’re entitled to pursue this claim. You need to prove that someone else was negligent and that it was their negligence that caused your injury. If you fail to prove negligence, you will not succeed in your case.

The second thing you must prove is that the injury that you suffered is a serious one. Again, if you can’t prove this you will lose your case.

If you succeed in your case, you can get paid for the pain and suffering you have gone through and will go through, and the loss of earnings you’ve experienced because of the accident, and will experience.

The pain and suffering side of things is calculated based on previous cases that have come before yours. So part of a lawyers job is to work out where your pain and suffering consequences t based on previous cases. This is one reason why having an experienced TAC lawyer is important.

As far as loss of earnings goes, many people assume that this is calculated by working out what income they’re losing until retirement age. This isn’t correct.

Working out loss of earnings is a bit more complicated than that. For example, lawyers need to take into account the risk that you might not work until retirement age, or that you might not even live to retirement age.

These common law claims must be initiated within six years from the date of your injury (there are some exceptions to this).

Sometimes these cases go to court, but more often than not they settle beforehand. If your case does go to court, sometimes it will be before a judge alone, other times it will be before a judge and jury. Usually TAC cases are heard in the County Court of Victoria, but in a smaller number of cases they can be heard in the Supreme Court of Victoria.

Does TAC cover property damage?

The TAC do not cover property damage. That is, if you suffered damage to your vehicle in an accident, regardless as to whether the accident was your fault or not, the TAC will not cover this damage.

Can I sue for loss of income?

If someone else was at fault for the accident, you are able to sue for loss of income. To do so, you must pursue a common law claim for damages. Any loss of income that you have suffered and will likely suffer into the future will need to be substantiated in order to succeed in a claim.

Will the TAC pay for my medical expenses?

The TAC will pay for the reasonable cost of medical and like expenses incurred as a consequence of an accident. There are limits to what the TAC will pay for and further information can be found on their website

How long do I have to make a TAC claim?

Generally speaking, the deadline for lodging a TAC claim is 12 months from the date of accident. Sometimes, this date begins once your injuries become apparent. In some cases this twelve month time-limit can be lengthened in certain circumstances – eg: if there are reasons to warrant the delay in lodging a claim.

What else should I know about TAC claims?

Most importantly, TAC claims are not limited to car accidents on what you would think of as a public road (like a highway or street). TAC covers various “motor vehicles” like quadbikes, motorbikes or tractors.

They also cover injuries occurring on private property or off-road.

You have the right to be treated by the doctor of your choice. You do not have to agree to be treated by a doctor approved by the TAC or public hospital if you don’t want to. Your treatment is your choice.

TAC is responsible for reasonable travel costs for receiving medical treatment or rehabilitation. If claiming taxi expenses, have TAC approve them first. If you drive, record the kilometers travelled and submit details to TAC for payment.

Keep a diary of the impact your injury has on your social and family activities and ability to participate in any sporting activities and hobbies.

You have the legal right to request copies of any medical reports obtained by the TAC regarding your claim.

Ensure the details on the reverse side of the medical certificate are complete or accurate or TAC will not pay your weekly payments. Usually, TAC medical certificates you obtain from your doctor run for a period of 28 days. If you intend to be away longer than 28 days and therefore won’t be able to obtain an update certificate within this time, permission to obtain a medical certificate that covers a longer period can be obtained from the TAC.

Motor vehicle injury lawyers in Warrnambool, Claven Burdess Lawyers.

If you need advice in relation to the lodgement of a TAC claim, feel free to contact us. We provide a free initial case assessment and advice to get your initial claim lodged. In addition to this, we also provide ‘no win no fee’ representation.

Contact

Phone

(03) 5516 7973

Address

455 Raglan Parade, Warrnambool, VIC 3280

Post

PO Box 327 Warrnambool, VIC 3280